Gurbaksh Chahal

3 Exits $400mm+ | Author | Investor | Philanthropist | Keynote Speaker | Guest Lecturer

“If you genuinely want something, don’t wait for it – teach yourself to be impatient.”

Gurbaksh Chahal Builds Businesses

Gurbaksh Chahal is Chairman & CEO of ProcureNet, BNN Breaking, ePiphany AI.

Gurbaksh previously founded RadiumOne, BlueLithium, ClickAgents and The Chahal Foundation.

Recent Posts

Latest From Gurbaksh

blog

All From The Blog

A three-way VC-Founder-Journalist ecosystem of greed, power hunger-fame is contributing to the current Tech Fallout

Greed consumes VCs at all times, which is understandable given the nature of their business. And, of course, they are numerically obsessed. When everyone starts…

It’s Time to Have a Serious Conversation About Mental Health

Have you ever felt as if all the doors closed around you and you were claustrophobic to the point of suffocating your own breath? Then…

Bite The Bullet

1999 was a year which I remember only too well, and for two reasons. The first being that it was the year when I started…

The BeLimitless Reboot: Don’t Settle, BeLimitless

Have you ever felt that sinking feeling in the pit of your stomach, that this is the moment when it’s all going to come down…

Chahal Foundation Turns Ten

I founded the Chahal Foundation when I was twenty-nine, because I wanted to make a difference, but I was naive enough to think it was…

Gurbaksh Chahal | Don’t try to be a unicorn. Be a horse. Horses win races.

If there is one thing that we have learned from history…well, it’s absolutely nothing. Bubbles last so long as the smartest guys in the room…

A three-way VC-Founder-Journalist ecosystem of greed, power hunger-fame is contributing to the current Tech Fallout

Greed consumes VCs at all times, which is understandable given the nature of their business. And, of course, they are numerically obsessed. When everyone starts…

Gurbaksh Chahal | Don’t try to be a unicorn. Be a horse. Horses win races.

If there is one thing that we have learned from history…well, it’s absolutely nothing. Bubbles last so long as the smartest guys in the room…

Gurbaksh Chahal: The Winning Wake-Up Strategy for a Successful Day

Your morning alarm blasts you awake. You swear and hit the snooze button. You roll over for a few more minutes of sleep. And then,…

Gurbaksh Chahal: Ambition—Belief—Courage—Determination—Ethics: MY A TO E PLAN FOR SUCCESS

Many up and coming entrepreneurs often ask me for my rules for success. They seem to think that as they set out on their entrepreneurial…

Gurbaksh Chahal | Why Celebrity Sponsored Posts Shouldn’t Exist

Celebrity endorsements are not a new marketing concept. It is a time-honored marketing tool, dating back as late as 1930s for radio advertising, 1950s for…

Gurbaksh Chahal | The Art of Negotiation by a Singh

A wealthy Singh walks into a bank in London and asks for the loan officer. He says he’s going to Europe on business for two…

Gurbaksh Chahal | 6 Things You Can Do Before Breakfast to Make Your Day a Success

Good morning! I mean it. Have a good start to your day and you’ll greatly enhance your chances of having a successful day, every day….

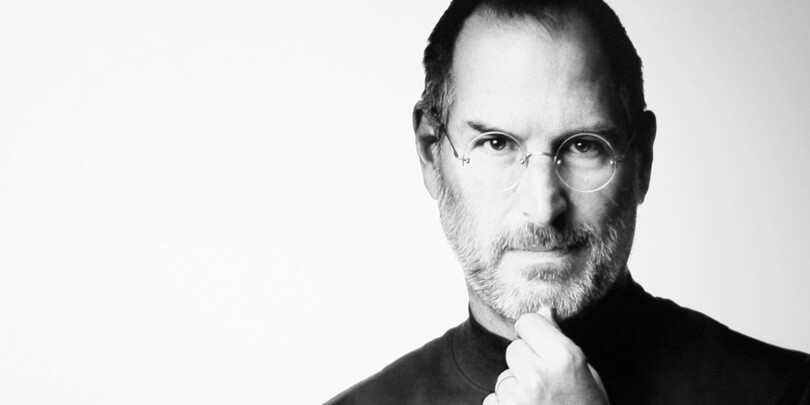

Gurbaksh Chahal | Steve Jobs’ Last Words

There is a claim that Apple co-founder Steve Jobs left behind a deathbed essay about how the “non-stop pursuit of wealth will only turn a person into a twisted being, just like me.” To many entrepreneurs, he is a legend and the epitome of success, having created the most valuable company in the world, and […]

Gurbaksh Chahal | 8 Things Life Taught Me

Throughout my journey, I’ve had my various ups and downs in my life that have tested my ability to stay successful. Everyone reaches these breaking…

Gurbaksh Chahal | Your IQ vs. EQ. What matters more?

We’re all intelligent—in one way or another. The architect uses a different kind of intelligence to a neurologist; a master carpenter is different to a…

Gurbaksh Chahal | Smart Answers to Awkward Interview Questions

An interview can be an intense experience. You’ve only got a few minutes to make a vital, possibly life-changing impression. The interviewer knows all about…

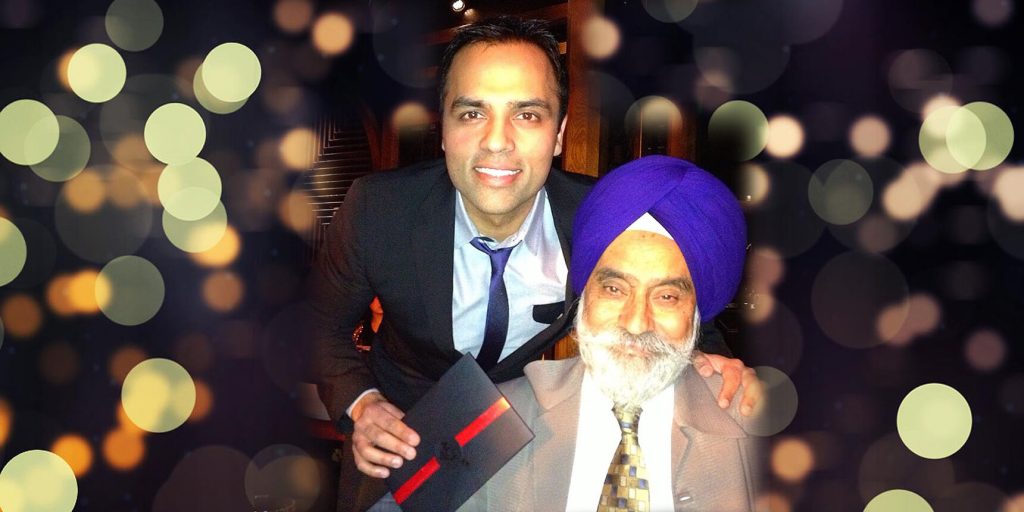

Gurbaksh Chahal | Best Advice: “Never Give Up”— the lesson I learned from my Father

It was October 27, 1997. I remember it as if it was yesterday. My family’s dream home was already half built. It was to be…

Gurbaksh Chahal | The Three Types of People You Will Meet in this World

Through your various ups and downs in life, you’ll get to meet three types of people. In reality, they are just a mixture of two…

Gurbaksh Chahal | Do it Anyway

The verses below reportedly were written on the wall of Mother Teresa’s home and are widely attributed to her. They express as they do, the spirit…

Gurbaksh Chahal | Why Paying it Forward Doesn’t Work

When I was a kid, I was taught to “Pay it Forward.” The concept of doing a good deed for someone else, when something good…

Gurbaksh Chahal | How The Unknown Leads To Success And Happiness

One of the greatest gifts I got was figuring, what my passion was at an early age of 16. I ended up dropping out of…

Gurbaksh Chahal | Oscar’s Most Profound Speech: Stay Weird, Stay Different.

Graham Moore is the 31-year-old author of one best-selling novel, one screenplay in production with Benedict Cumberbatch, another novel in the works, and a just-finished…

A three-way VC-Founder-Journalist ecosystem of greed, power hunger-fame is contributing to the current Tech Fallout

Greed consumes VCs at all times, which is understandable given the nature of their business. And, of course, they are numerically obsessed. When everyone starts…

The BeLimitless Reboot: Don’t Settle, BeLimitless

Have you ever felt that sinking feeling in the pit of your stomach, that this is the moment when it’s all going to come down…

Entrepreneurship and the Enemies Within

Do you know it’s possible as an entrepreneur to lose all your hard-earned success? You could lose everything in the wink of an eye. I…

Gurbaksh Chahal | Why 9 out of 10 Entrepreneurs Fail

Most would-be entrepreneurs start off with a dream. But nine out of ten quickly discover that you need more than an idea and the simple…

Gurbaksh Chahal: Ambition—Belief—Courage—Determination—Ethics: MY A TO E PLAN FOR SUCCESS

Many up and coming entrepreneurs often ask me for my rules for success. They seem to think that as they set out on their entrepreneurial…

Gurbaksh Chahal | Be Careful With Whom You Trust.

Gurbaksh Chahal is a man of remarkable fate. One of the youngest millionaires in the digital industry, over the years he founded four companies, each…

It’s Time to Have a Serious Conversation About Mental Health

Have you ever felt as if all the doors closed around you and you were claustrophobic to the point of suffocating your own breath? Then…

The BeLimitless Reboot: Don’t Settle, BeLimitless

Have you ever felt that sinking feeling in the pit of your stomach, that this is the moment when it’s all going to come down…

Chahal Foundation Turns Ten

I founded the Chahal Foundation when I was twenty-nine, because I wanted to make a difference, but I was naive enough to think it was…

Gurbaksh Chahal | Stay Alive: Pain is Temporary

Sometimes life tests you beyond your limits. Take a deep breath and stop feeling sorry for yourself. Endure the pain. The pain only subsides until…

Gurbaksh Chahal: The Winning Wake-Up Strategy for a Successful Day

Your morning alarm blasts you awake. You swear and hit the snooze button. You roll over for a few more minutes of sleep. And then,…

Gurbaksh Chahal: Be true to yourself. Never quit. Never give in.

Be authentic. Be the person you were born to be. Don’t waiver. Don’t get cajoled into wandering off the righteous path in your life journey…

Chahal Foundation Turns Ten

I founded the Chahal Foundation when I was twenty-nine, because I wanted to make a difference, but I was naive enough to think it was…

Gurbaksh Chahal | COVID Help: Need for Protective Masks

While in India, Rubina and I heard news of panic from the scarce supply of face masks to protect individuals from contracting the corona virus. She…

Gurbaksh Chahal | All I want for my birthday is…

To Pay it forward. Every year theChahal Foundation picks an important cause to support. During my last trip to India, I had learned that schoolgirls face…

Gurbaksh Chahal | The Many Ways You Can Make a Difference

Saying everyone can make a difference is a blanket statement, but it’s true. The world is big and there is something everyone can do. Gurbaksh…

Gurbaksh Chahal | Don’t Hesitate to Bring Good Change

The amount of suffering in this world is unimaginable, and children (and with them our future) are the most vulnerable victims of crime and outright…

Gurbaksh Chahal | Let’s End Child Sex Trafficking. #BeASuperHero

In India every hour, two girls under the age of 15 are forced into sexual exploitation with little hope for freedom. The human trafficking industry…

A three-way VC-Founder-Journalist ecosystem of greed, power hunger-fame is contributing to the current Tech Fallout

Greed consumes VCs at all times, which is understandable given the nature of their business. And, of course, they are numerically obsessed. When everyone starts…

Bite The Bullet

1999 was a year which I remember only too well, and for two reasons. The first being that it was the year when I started…

Gurbaksh Chahal | Entrepreneur.com’s Interview during a Q&A Special for Mother’s Day.

There is no job as thankless and selfless than that of a mother. On my Facebook today, I thanked my mother for giving me the gift of…

Gurbaksh Chahal | George Clooney: We Will Not Walk in Fear

As most know of you know by now, Paris has been in our prayers, after witnessing the bloodiest massacre the Country has faced in the…

Gurbaksh Chahal | It’s a sad day when the North Korean government can keep a Japanese corporation from making money off the American people.

Update. Props to Sony Pictures in making the right decision and releasing the movie online. You can stream it on YouTube for $5.99 here: The…

Gurbaksh Chahal | Religion Should Never Be an Excuse to Kill Innocent Children.

Two things, I’ve learned over the last 17 years on the Internet is to never blog about politics or religion. I’m going to take that…